This will be only the second time since our wedding in 2003 that my wife and I did not getaway for our anniversary. We can blame the Omicron variant for keeping us home. By adhering to distancing guidelines, only my daughter Sydney and I have tested positive. The office has also been a ghost-town as most of us have been sequestered at home. But this time at home has given me an opportunity to catch up on reading, research, and deep thinking. Our thinking has not changed markedly over the last few months. We still feel we are experiencing the “Melt Up” phase of the market but our thoughts on when the party may be ending have shaped up a bit recently.

In early November we wrote about the “Market Melt Up” continuing through Christmas. The infrastructure bill promised spending that looked to be potentially productivity-enhancing in the long run with additional potential stimulus in the short run. The Democrats set the stage for even more fiscal spending by deciding to vote in a debt ceiling increase without the Republicans. However, the Federal Reserve has turned somewhat hawkish over this time period as they have unveiled a playbook where the monetary stimulus is pared back over the next few months with potential rate increases over the next year as well.

Is “Build Back Better” Stimulus Possible without Federal Reserve Accommodation?

Most likely the afore-mentioned fiscal stimulus is only possible if “Build Back Better” is passed solely by the Democrats in the Senate. Joe Manchin is unlikely to allow this to happen in its current form with the specter of inflation at its strongest in 40 years and a widespread desire by most Americans to temper the out-of-control “gas and grocery store tax”.

If this bill is passed in some form, it is likely our government will need to issue more debt to fund the spending. But who will buy the bonds? In the recent past, the number one U.S. Treasury bond buyer has been the Federal Reserve. It seems unlikely we can easily fund continued fiscal spending without accommodation from the Federal Reserve. Issuing the numbers of bonds needed for the proposed spending from this bill would likely drive interest rates markedly higher (if no one else wants the bonds, interest rates go up to make them attractive). It seems the Federal Reserve may be forced to make an about-face if the bill is passed. As it stands, it seems more likely that the bill is dead for the remainder of 2022.

December proved to be a month where most looked hard to find holdings to sell at a loss. The markets cooperated and the worst recent performers of the second half of 2021 continued their slide. Many were hopeful that inflation would start to de-accelerate toward the end of the year, but it looks like we will have to wait longer for prices to moderate.

Next stop for oil prices: $110 a barrel?

Why would we want “Coal in our Stocking”?

With the Biden Administration flooding the energy market with strategic reserves to lower energy prices toward the end of the year, many felt inflation may start to come under control. With West Texas Crude Oil now priced at over $84 a barrel, we may soon find ourselves at multi-year highs. Oil prices can move another 25% higher before reaching 2014 highs. Uranium prices have also spiked with many talking about Nuclear power utilization. Even coal prices have moved markedly higher. It seems that we may need a recession to temper these runaway price increases.

A little over a year ago, Stanley Druckenmiller, the billionaire investor and founder of Duquesne Family Office said inflation could reach as high as 10% with markets in a “raging mania.” That party, he told CNBC at the time, will eventually end in a “hangover.”

It seems we are close to proving his predictions true with the Consumer Price Inflation and the Producer’s Price Inflation rising to 7.0% and 9.7% respectively in December.

“Once inflation reaches today’s levels, behavior changes are triggered, and it becomes embedded in wages (corporate response) and such, the only endgame is a fall into a recession. The Fed’s belief that inflation will normalize down to target from 6.8% in the next couple of years while unemployment goes to 3.5% as fed funds are raised to 1.5% has NO historical precedent.” – Stanley Druckenmiller

Do Valuation Metrics Still Matter?

As we noted a couple of months ago, “many feel valuation metrics used over the last century may no longer be as viable. Using relative valuation metrics and measurements based upon assumed correlations has become more commonplace. We have found through internal and external studies that some of the best metrics to measure against are those that are the hardest to fake. Dividend yields have proven extremely difficult to fake in that we know immediately if the company is paying us regularly or not. Revenues also tend to be harder to fake than profits, although some companies have developed ways to inflate these numbers as well. Fraudulent accounting becomes more and more commonplace as we march toward manic periods where investors are experiencing a fear of missing out.”

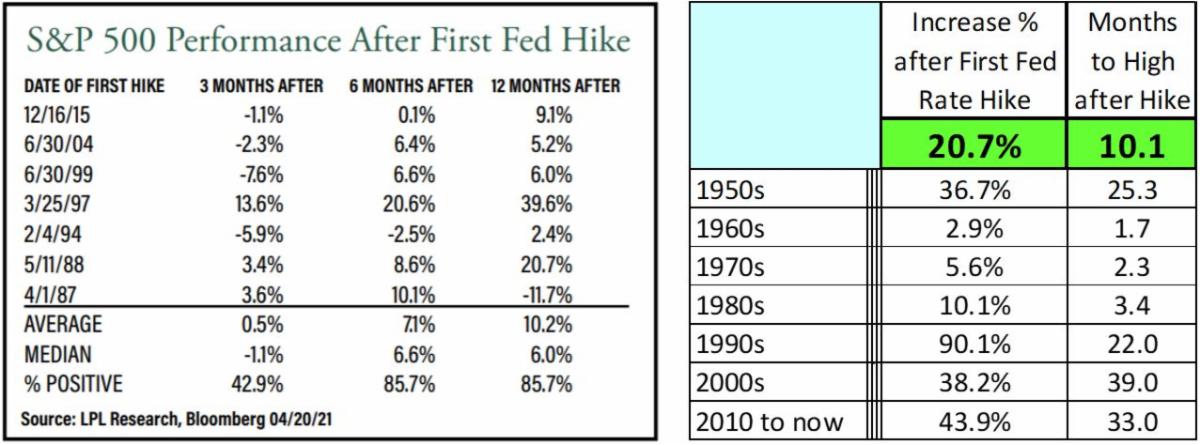

It seems that others are thinking along a similar vein as the new year emerges. So far, it seems there has been a renewed interest in dividend-paying companies as growth and momentum names have fallen off markedly. The technology-laden Nasdaq has fallen off more than most indices, but this does not tell the whole story. Smaller technology companies are faring much worse than the mega-cap market leaders. Many of these companies are down 50% or more from their highs currently. Is it possible these will recover with a renewed interest in high-growth popular names? Absolutely. The markets can grow more with even frothier valuations, even as interest rates start to increase. As the chart below makes clear, since the late 1980s, markets provide positive returns over 85% of the time after the Federal Reserve starts raising rates.

Looking at this further, since the late 1940s, markets tend to peak approximately 10 months after the Federal Reserve starts increasing rates with an average gain of over 20%. More recently, markets have tended to peak only after the Federal Reserve has started to decrease rates as they determine that the economy is starting to weaken. It is likely we see the market mania continue in certain sectors as valuations continue to inflate. We doubt the Federal Reserve is going to be willing to tighten substantially anytime soon, even though many feel they may be trying to kill the golden goose.

2022 Is Likely to be a Year of Transition:

It seems the “Build Back Better” bill may be dead. It also seems likely that both houses of Congress may shift to the Republicans in the mid-term elections. In general 2022 is shaping up to be a year where things cool off a bit. As Ray Dalio recently wrote: “As a result, I expect that most likely 2022 will be one of those transition years that come after the big stimulations and before the big tightenings and recessions—e.g., more like 2010-11 than 2008, or more like 2002-03 than 2000. With the economy more than back to having capacity constraints and experiencing inflation, there will be a lessening of the extraordinary easing and some tightening but probably not enough to kick things over.

Typically in this phase of the cycle equities and other asset prices rise at the same time as interest rates rise. Also, typically in this phase of the cycle economic and market volatility is lower than in those exciting years that mark the major tops and bottoms of the short-term (eight years, +/- four years) economic and market cycles.”

Where do we see Opportunities?

As we noted a couple of months ago, “In almost all time periods, there are places to invest where we can find attractive values. Currently, the most attractive values can be found in emerging markets. These markets may continue to get cheaper, but when they start to turn around, we see more upside over the long term. We have noted that many professional investment managers we admire are actively buying Chinese technology companies currently.

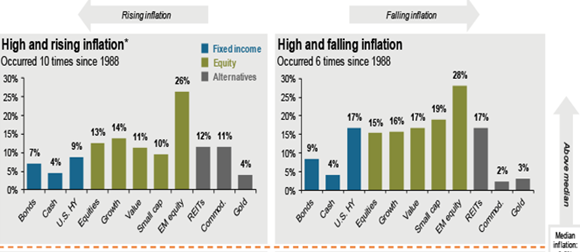

Last year, commodities and energy, in particular, looked extremely cheap as investors were paying others so that they would not have to take delivery. Negative prices are exceedingly rare, but this is what we saw when all storage facilities were filled to the brim. Of course, we are now concerned about inflation and prices are continuing to march higher. We want to do what we can to protect from this inflation by owning energy companies, REITs, mining companies, and other investments that can benefit from higher prices in the future. Blockchain investments also fit this mold as many consider NFTs and cryptocurrencies to be commodity-like. Scarcity rules in today’s markets. We want to own scarce assets as there is more currency chasing fewer and fewer goods.

Diversification is almost always a good idea. Diversifying into multiple investments that you understand well, is an even better idea. Diversification into a few temporarily undervalued investments with significant upside that you understand well tends to provide the best results over time.”

MARK YOUR CALENDARS: What To Expect in 2022

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.