Jennifer and I enjoyed visiting Belize, and avoiding the cold rainy weather in Tennessee for a couple of weeks was a welcome change. When the doctors told us we could not leave for another four days after Jennifer recovered from her medical issues, we took advantage of the chance to see more of the country.

During our last few days in the country, we noted that many trees and flowering plants were blooming that would typically not come into season until June or July at home. I told the shopkeeper that the Crape Myrtles and Canna Lillies are summer flowers in Tennessee. However, they did not realize that those flowering plants were seasonal in other parts of the world.

Jennifer showcasing Crape Myrtle and other “Summer Flowering” plants in February.

In recent weeks, we have learned that it is best to reposition the spring portfolios as the reduced asset purchases. Possible interest rate hikes are typical signs of an economic summer. Battering down the hatches for a winter recession may be a little premature when the “signs of spring” are just starting to dissipate, and the “signs of summer” are just beginning to emerge.

We want to protect from the various “winter storms,” just like the other winter storms we have previously experienced. Economic seasons progress directly from summer to winter. However, we have never experienced a winter beforehand without going through a “summer period.”

What About Floods, Tornadoes & Other Nastiness?

Other types of nasty weather can affect us outside of the winter periods. Similarly, markets can suffer from storms without going through a recessionary bear market. The pictures and the video shows what we have done to help turn our yard’s potentially waterlogged, erosion-prone areas into more beautiful spots. Rain can turn the wet yard into something you dread and arrive into something you can enjoy. In some respects, it enhances other features.

When we moved into our home a decade ago, we had no water features such as the pond above. This pond and creek leading up to it was completely dry this past weekend but has filled up over the last couple of days. We added the waterfall and pond a few years ago. These features added some variety to our yard while keeping the rest of the property from becoming too wet.

Above we added some plants that love water such as the Louisiana and Japanese Irises. Due to their wet habitat, they have naturalized across our backyard over time. It is hard to believe that initially there were only a dozen tubers. We now have hundreds of these flowering irises that add color to our yard in late spring and early summer.

This autumn blaze maple was planted over a dozen years ago and has already grown close to forty feet tall. It loves to soak up the water that gathers around the trunk. As time has passed, less and less water collects around the patio area as the maple tends to drink up almost everything. So I took a picture of the maple below immediately after the recent rain.

This patio and retaining wall with a fence behind it were the first features added to the yard after we moved into our home in 2008. The builder had planted a few hedges at the bottom of a slope that fed straight into the culvert. It did not take long to realize that over time, everything would erode into the ditch. It looked terrible. Today, we have Jane magnolias that start blooming in March. We have lemon-scented sweet bay magnolias that bloom in May that surround the patio and add shade in the summer. They make the area a joy to gather in most of the year.

What Does This Have to Do with Investing?

Much like we want to be creative and adaptable with our yards, to be able to turn eyesores into beautiful features, we can also position our portfolios to take advantage of crises and use these opportunities for profit. Bond investments have rarely looked less attractive, with interest rates at multi-decade lows and threatening to rise. Couple this with high inflationary pressures, and we are almost guaranteed to lose in traditional fixed-income investments.

We Can Take Advantage of Inflation

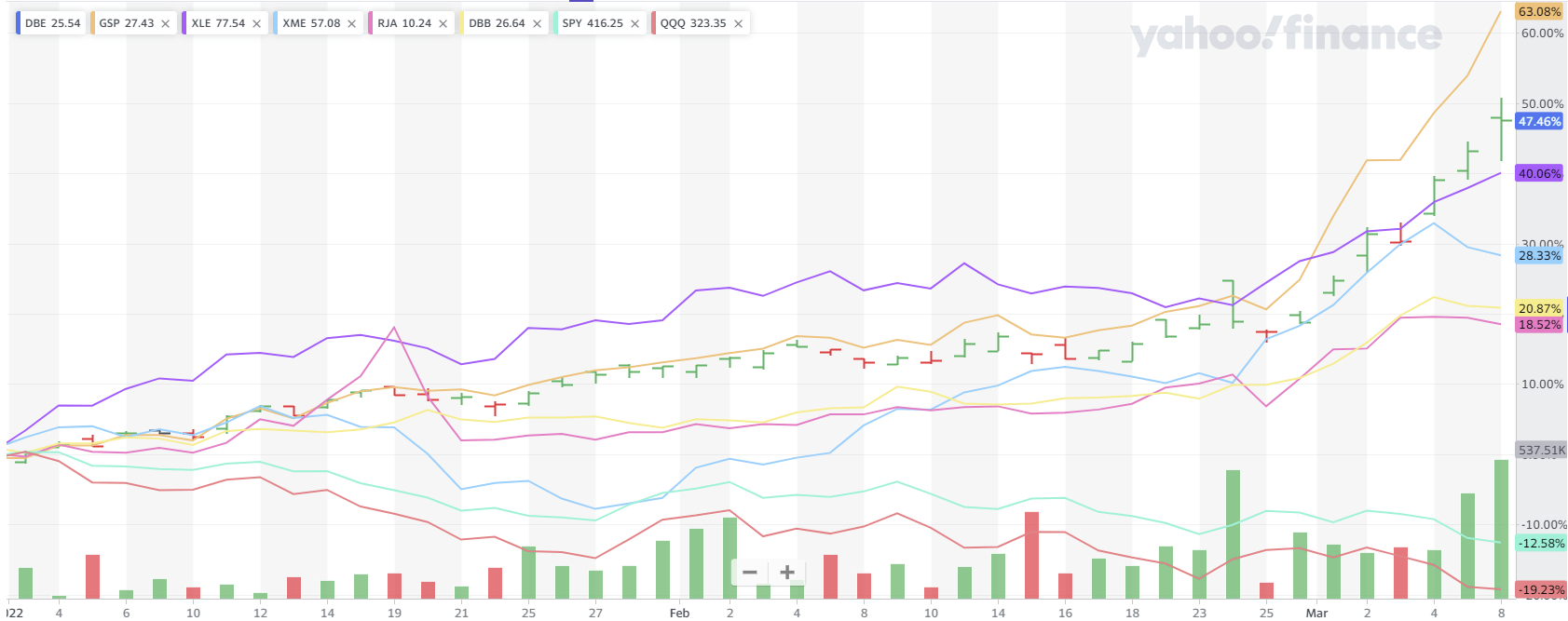

Investing in areas where prices are increasing can overcome market downturns exacerbated by inflationary concerns and potential interest rate hikes. For example, many energy companies, miners, REITs, and other investments that benefit from inflation also pay dividend yields higher than most bond yields. Year to date, many of these types of investments have performed exceptionally well, while some of the more popular indices have fallen substantially. Above, you can see how well some inflation-focused positioning has fared this year through Tuesday, March 8th. The chart below also shows the same indices in a different format for those who are more visual.

Before the pandemic, our inflation protection positioning rarely exceeded ten percent in client portfolios. More conservative accounts are more protected than more aggressive accounts. However, starting in March of 2021, we increased this inflation protection within portfolios, with Real Estate and Energy reaching a concentration of up to 15%. By May 2021, we had further increased this percentage to be slightly greater than 27% in some portfolios. Since late December, this percentage has risen in increments of 5% each month reaching just over 40% overall.

How Do We Protect Our Portfolios From a Potential War with Russia?

We see continued sanctions against Russia contributing to continued price increases in oil, agricultural prices, and precious metals. Transportation costs and other derivative products will also be affected. When will the pain grow large enough to either dampen, demand or motivate the rest of the world to produce? Hopefully, we will see productivity increases and increased production at home and abroad as we all step up our efforts to be more competitive. Price decreases due to increased production keep the economic engine humming. We only have to look to the failed policies of the 1970s to see what could happen if we try to reduce prices thru other means.

As prices continue to rise, the inflationary positioning in our portfolios should continue to outperform. If we increase production at home, energy companies and miners should also do well in these portfolios. If we fail to address the core issue by being more productive, we are much more likely to spiral into a recession, and prices will eventually come back down. However, this is the least attractive option.

We anticipate Consumer Price Inflation and Producer Price Inflation both hitting new highs this month. Energy prices, when inflation-adjusted, are not quite at 2011 levels and are still a bit lower than what we experienced in 2008. We still have a little runway before hitting inflation-adjusted highs in many of these areas. It’s hard to see supply outstripping demand anytime soon. Hopefully, this is what we can eventually experience when we find ways to be more productive globally without relying on Russia.

If you have a waterlogged yard, consider building a pond. If you are concerned about getting beat up by inflation, why not benefit from it by positioning your portfolio to profit from these price increases.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.