Why Aren’t Banks and Money Markets Paying Better Yields?

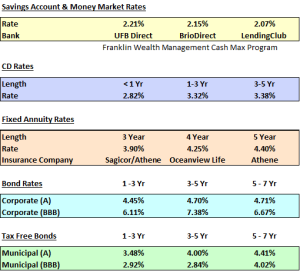

With treasury yields at multi-year highs, you might expect banks and money markets to be paying better than they are currently. Banks and brokerage firms like to make a profit and many will keep these rates low for as long as possible to maximize these profits. There are a few banks and money markets that are paying better yields in this environment, however. We have been able to partner with some of these banks through our association with TD Ameritrade as they compete for deposits. Rates now over 2% on FDIC insured savings accounts (see below) and we are able to get automatic optimization of yields on a monthly basis through our Cash-Max program.

If you are tired of “Lazy” dollars laying around in money markets and savings accounts and want to learn more, feel free to watch the video above or reach out to us and we can help.

For more on creating a bond / CD ladder or looking into specific offerings please feel free to contact Carter Payne in our office.

Treasury yields moved mostly higher last week. The very short end of the curve was unchanged, but from 3 to 30 years out, yields finished the week higher. The 10-year Treasury has steadily marched higher since its recent low of 2.60% at the beginning of the month. It closed on Friday at 2.98%, a nearly 40 basis point (0.40%) move higher in about 3 weeks.

Investment-grade corporate yields followed benchmark yields higher, as both the A-rated and BBB-rated curves finished the week with yield increases across the board. The most significant moves in corporate yields were in the 5 to 10 year range.

The municipal bond market was the most active corner of the fixed income market last week, with large yield gains across the asset class. The short end of the benchmark AAA curve finished the week 32 to 51 basis points higher. For an investor in the 37% federal tax bracket, those are taxable equivalent yield increases of 52 to 81 basis points for the week. The intermediate and long parts of the AAA curve moved 18-20 basis points higher. These moves pushed muni-Treasury ratios higher across the board, an indicator of increased relative value in the municipal market.

This week provides a lot of economic data for the market to digest, highlighted by PCE (Personal Consumption Expenditures) data this Friday, which is the FOMC’s preferred measure of inflation. Expectations are for a year over year increase of 6.4% according to Bloomberg. While well above their target of 2%, it would be a decrease from last month’s 6.8%. The consensus estimate for the year-over-year Core number is 4.7% which would be a slight drop from last month’s 4.8%.

CD rates were lower for the week. The number of available issuers decreased slightly while the total number of CDs available also decreased. The average yield-to-maturity was also down for CDs with less than 1 year maturity, from 2.513% to 2.442%.

Again, if you would like to earn better rates on cash and are already working with us, please feel free to ask us about Cash-Max. If you want to look into competitive rates for CDs, or tax free bonds in building out a laddered portfolio, our team can help create a solution for you.

Joe Franklin, CFP®

President, Wealth Advisor

Franklin Wealth Management, LLC