We will be celebrating Halloween with our kids again today. I feel lucky that they still want to celebrate and invite their friends to hang out and “trick or treat” in the neighborhood. Our family is a fan of the “not so scary” version of Halloween and enjoy treating the kids as they come by the house in search of candy. The crowds are not quite as large as they were before the pandemic, but hopefully soon, everyone will overcome their fear and Halloween may be more fun for all children once again.

I would like to see everyone be able to overcome the fear that has gripped the country over the last couple of years. Many years ago, I learned the FEAR acronym where FEAR is defined as “False Evidence Appearing Real”. Many have been fearful for their health, their jobs, unwarranted attacks, wars and rumors of wars, inflation, and market downturns. Many have lost loved ones, livelihoods, purchasing power and perceived freedoms. We can only move ahead by overcoming this FEAR and planning well for the future based upon what we know from history and data, however. It is always darkest before the dawn and the best of times often follow the worst of times. Hopefully we can all take advantage of the opportunities as they present themselves rather than being too timid to make a move.

The Best of Times and the Worst of Times

As we noted recently, the worst month for the market historically is September and markets most often bottom in October. The “Halloween Indicator” tends to show that it is best to “Be Greedy when others are Fearful”. Those who buy on Halloween and hold for the next six months have caught the majority of market gains over the last seventy years. This “good period” for investing starts in mid to late October and continues typically until May. Since 1950, the five best performing months of the year for the S&P 500 Index have been November, December, January, March & April with six of the seven worst months being May through October. Many are fond of saying “Sell in May and Go Away”, but they woud also be wise to remember to “Buy in October and Get Yourself Sober”.

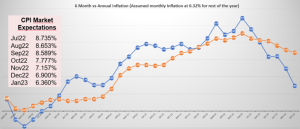

A Look at Inflationary Expectations

Much of the data suggests that inflation may be starting to moderate. The last three months if annualized would provide an inflation rate of only 2%, but it is unlikely that we will be able to beat back inflation in only three months. Past inflationary periods have lasted a decade or more when we consider the 1940s inflation, the 1970s era when the ” Misery Index” was first coined, and the 2000s commodity and real estate inflationary boom which looked like it ended with the financial crisis in 2008. Many remember depressed real estate prices after 2008, but may not recognize that precious metals, agriculture, energy, and many other commodities came roaring back after the financial crisis.

It looks likely that inflation will continue if Congress continues passing financial stimulus packages, sending checks to and forgiving loans of those it deems worthy. We’ve seen the effects of fiscal stimulus packages gone wrong when the former Prime Minister of the U.K. unveiled a two-year cap on energy prices (funded by the government) and tried to engage in massive tax cuts to stimulate the economy at the same time the Bank of England was trying to fight back inflation. The train almost came off of the tracks, the pound devalued to its lowest level versus the dollar since 1985, and the U.K. Prime Minister resigned after only 50 days.

From Overheated to Frozen to Overheated Again?

If the composition of Congress changes so that we have more checks and balances in Washington, it is likely that we will see less fiscal stimulus, inflation will continue to come down over the next year and interest rates may peak by the end of the year. If year over year CPI declines to under 7% by the end of the year, the six-month annualized rate of inflation would decline to approximately 3%. The interest rate increases and monetary tightening from the Federal Reserve is very likely to send the economy into a deeper recession, but this may bring down inflation rates to their target rate of 2% or less by mid-year. Unfortunately, the Federal Reserve is likely to swing the pendulum too far in the other direction, killing the economy in order to tame inflation. These pendulum swings are likely to be wide if Congress continues to pass large spending packages to revive the economy, rather than engaging in the more moderate measures coordinated with sound monetary policy.

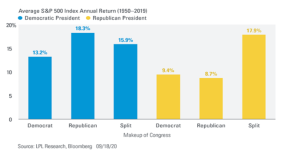

Which Party is Better for the Markets?

Most anticipate that the Republicans will overtake the House of Representatives with very little change in the composition of the Senate. Assuming this, we would also anticipate interest rates peaking by the end of the year with rates exceeding the six-month annualized inflation rate by the time the November CPI numbers are released. This would be a great time to own bonds, especially if we start heading into a deeper recession. We wrote on this more extensively in our recent article, Time to Refill the Barn (click link to read).

Our country could use a few good peacemakers and statesmen. When parties are encouraged to work together and reach across the aisle, the government has historically run more smoothly. The markets also tend to perform best with a divided government. Continued partisan fighting and name calling may be inevitable. However, I still hold the hope that we can elect leaders that can peacefully debate, encourage dialogue and pass bipartisan legislation.

Forbes Recognized Joe Franklin as one of the Tops Advisors in Tennessee

4700 Hixson Pike

Hixson, TN 37343

(423) 870 – 2140

www.Franklin-Wealth.com