Has Warren Buffet Lost His Touch?

What we are seeing now in the markets brings back memories of late 2000.

Technology spending had gone through the roof as companies scrambled to get their systems updated for perceived “technological calamity” during the YTK hysteria at the end of the decade. The Federal Reserve was continuing to hike rates until just after the market hit a long-term high in March of 2000. These hikes stopped in May, but we did not know these hikes were over until 2001. The market looked like it might hit new highs later in September, and most were not considering how overvalued most technology and internet companies had become at the time.

In the late 1990s, day trading was in full swing, growth stocks went to the moon and value stocks languished. In late 1999, as Berkshire was underperforming the S&P 500, Barron’s magazine published an article entitled “What’s Wrong, Warren?” and proclaimed that he might have been losing his magic touch. “To be blunt, Buffett, who turns 70 in 2000, is viewed by an increasing number of investors as too conservative, even passé,” the article said. “Buffett, Berkshire’s chairman and chief executive, may be the world’s greatest investor, but he hasn’t anticipated or capitalized on the boom in technology stocks in the past few years.”

Shane Parrish from Farnam Street, a value-based research firm, summed up Buffett’s strategy: “You have to be willing to look like an idiot in the short term to get the best long-term results. I’d suggest that because the future has become increasingly uncertain, he’s preparing for the widest range of possible futures.”

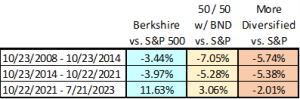

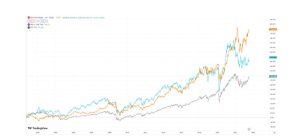

Buffett has been underperforming the S&P 500 now during most of the periods since late 2008 (see chart above).

Buying an S&P 500 Index would have rewarded investors with greater returns. Investing in one of the top 10 companies in the S&P 500 would have performed even better. Many cryptocurrency investments provided returns many multiples higher as well. An investment in Berkshire Hathaway underperformed the S&P 500 by close to 3.5% from late 2008 through late 2014 and by almost 4% from late 2014 through late 2021. Smaller companies (light blue in the chart above) have outperformed larger companies by a wide margin over the last century and Buffett (orange in the chart above) has proven to be the best investor of the past half century. However, this has not been the case for the last 15 years.

Most investors prefer to own a more diversified portfolio and keep their risk level lower than that of an All-Equity portfolio.

This involves owning bonds and possibly some alternative assets like real estate and other assets that benefit from inflation. But when the S&P 500 is hitting new highs and doing better than most other indices, the “Fear of Missing Out” pushes many to focus on this index. Being diversified looks like a losing strategy when large companies in the U.S. are outperforming by a wide margin. We have seen periods where these largest, most popular companies outperform for a while, and underperform greatly in the ensuing years. Those experiencing the Index “F.O.M.O.” may want to read Would Warren Buffet Want You as a Partner.

Why Avoid the Biggest, Most Popular Companies?

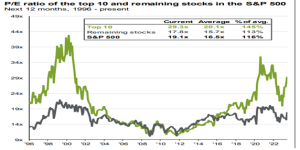

The last time we saw interest in the largest most popular companies reach this type of frenzy was in 2000. When considering these companies from 2000 and how well they have performed through the highs of 2021, we can see that most have actually lost money in the ensuing couple of decades. Valuations tend to revert to the mean and currently the top ten market cap companies are trading at a price-earnings ratio of almost twice that of the rest of the index. The last time we saw this type of valuation spread between the top ten and the rest of the index, this premium was erased within three to four years.

De-ja vu for the S&P 500?

The chart below shows how the S&P 500 fared in the 1990s when valuations became stretched to a similar degree and the largest companies were outperforming by a wide margin. We can see that the only two decades where the S&P 500 has outperformed all other indices was the 2010s and the 1990s. In most other decades, smaller companies and emerging markets / industries outperformed.

The outperformance of the S&P 500 in the 1990s led to the underperformance in the 2000s. Those who chose to shift from a diversified portfolio to focus on the index and the top 10 companies suffered the most during the “lost decade”. Those who stayed diversified in a more diversified “All-Equity” portfolio or chose to take less risk in an even more diversified “Conservative” portfolio, still showed positive returns. Conversely, the S&P 500 and the biggest, most popular companies provided negative returns in the ensuing decade.

Warren Buffett has a bit to say about making predictions and how to invest over time, for more on this please follow this link to Warren Buffett’s Predictions.

Taking a Longer-Term Perspective

The chart below shows how Berkshire Hathaway (Orange) and smaller companies (light blue)

performed against the S&P 500 over the past 25 years. Even with the S&P 500 outperforming for fifteen of the past 25 years, Berkshire Hathaway appreciated over twice as much as the large company index. As can be seen from the chart below, smaller companies also outperformed the large company index and even outperformed Berkshire until late 2021 when Buffett’s value-oriented strategy started to come back into favor.

So why do we still feel that Berkshire Hathaway continues to be a great investment?

- The company is currently generating about US$2 billion a month in excess cash, a staggering number.

- Berkshire has plenty of dry powder remaining. Prior to the LNG energy purchase last month, the company was still sitting on a mountain of cash. If you are an indexer and want to buy stocks, this seems crazy. But just like he poured assets into cheap stocks in 1974 and again in 2000 when the market collapsed about 40 per cent, as well as during the 50 per cent collapse in the Great Financial Crisis of 2008, we believe that cash will be deployed once Buffett is able to find a few large bargains.

- Even with the recent rally, the stock is still relatively cheap. In the last couple of years, Berkshire has been trading near book value, something we had not seen since the financial crisis. It’s rallied a bit since then, but is still a relatively good value.

- Lastly, the company remains predictable, and focused on capital preservation. Buffett, and those that follow him in managing Berkshire, will continue on the path that Warren and Charlie have laid out: find companies with sustainable competitive advantages, repeatable earnings models, room for growth, significant free cash flow, and great management teams at the helm. And if they can’t find such companies at attractive prices, they will wait.

When the crowd starts thinking that one of the greatest minds in the world has lost it, all you have to do is look back at his historical successes, which include his non-actions, as he waits for exactly what he wants.

What’s required for investors, which Buffett has demonstrated repeatedly, is the virtue of patience. As noted above, every time, that has rewarded shareholders handsomely. We believe he and we will have that wonderful opportunity.

Forbes Recognized Joe Franklin as one of the Top Advisors in Tennessee

Franklin Wealth Management, LLC

4700 Hixson Pike

Hixson, TN 37343

(423) 870 – 2140

www.Franklin-Wealth.com