Momentum versus the Economic Cycle

Will the Next Decade be More Like the 2000s or the 1970s?

Last week, we held our “Hurricane Survival” 2023 Halftime Report, and many people may feel our warnings seem like Chicken Little concerned that the sky is going to fall. Since the bank failures in March, we have seen a significant rally in the markets. Bullishness is at levels last seen in mid 2021 and with the opening of the Fed. Window to wipe out beleaguered banks’ treasury bond losses by buying up their under-water treasury bonds, most seem to have thrown caution to the wind.

The Federal Reserve raised interest rates by a quarter of a percentage point on Wednesday and Fed Chair Jerome Powell said the economy still needed to slow and the labor market to weaken for inflation to “credibly” return to the U.S. central bank’s 2% target. He seems to feel he can afford to keep raising as long as the Stock Market provides him cover. But there are several concerning weather patterns developing off the “economic coast” that we may want to watch for.

In our most recent article entitled “Has Warren Buffett Lost His Touch?” we noted that Warren has not participated in this momentum game and many people are starting say that he is growing too old and conservative, much like late 2000. However, during the following decade, Buffett and Berkshire Hathaway widely outperformed the S&P 500 by a wide margin with the index providing negative returns through the end of the 2000s.

Buffett had also stayed away from stocks in the early 1970s as he noted that he couldn’t find anything he wanted to buy at the time. However, by 1974 when asked how he contemplated the current stock market, he replied, “Like an oversexed guy in a harem, this is the time to start investing.” The Dow was below 600 when he said that, and before Forbes could get Buffett’s words in print, it was up almost 15% in one of the fastest rallies ever. What’s interesting to note is that Buffett is not as concerned about what has done best recently as he is about the price of what he can buy compared to its value, and whether he feels he can pick up bargains.

We have not seen rates increase at such a rapid pace since the 1970s and early 1980s as Chairmen Burns and Volker pulled out the stops to tamp down inflation. However, valuations were not at such lofty levels by many metrics in the early 1970s as they still are today. Even though we are below the highs last seen in 2021, the biggest, most popular companies still look expensive and have provided most of the impetus for this last rally.

The End of Summer is Upon Us?

We can see below what typically transpires just before recessions hit and markets turn down to new lows. After a period of rate increases by the Federal Reserve to temper inflation, the yield curve starts to invert and short-termInversion bonds and CDs start to pay higher interest than longer maturities. This is known as a yield curve inversion and has telegraphed a recession every time since the late 1960s.

Many times, markets do not reach their highs until after the inversion period is over and the Fed. starts cutting rates. When the curve gets back to normal and we go through “the steepening”, history tells us that we want to be getting out of equities.

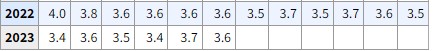

Chairman Powell told Us Employment is Still Too Strong

Employment is typically one of the last dominoes to fall prior to past recessions. The U.S. Dollar has already started to weaken since October of 2022 and on July 7th, the Bureau of Labor Statistics released data showing the unemployment rate is currently at 3.6%. What is interesting to note is that the unemployment rate is not on an upward trajectory with the last two months clocking in higher than the 12 month average. When this has happened in the past, it is typically not long before unemployment spikes and we are in the middle of a recession. In the past, the markets on average have rallied close to 8% from the time the data comes out only to fall significantly afterwards. In the chart below, you can see how the markets have fared after Unemployment begins its upward trajectory.

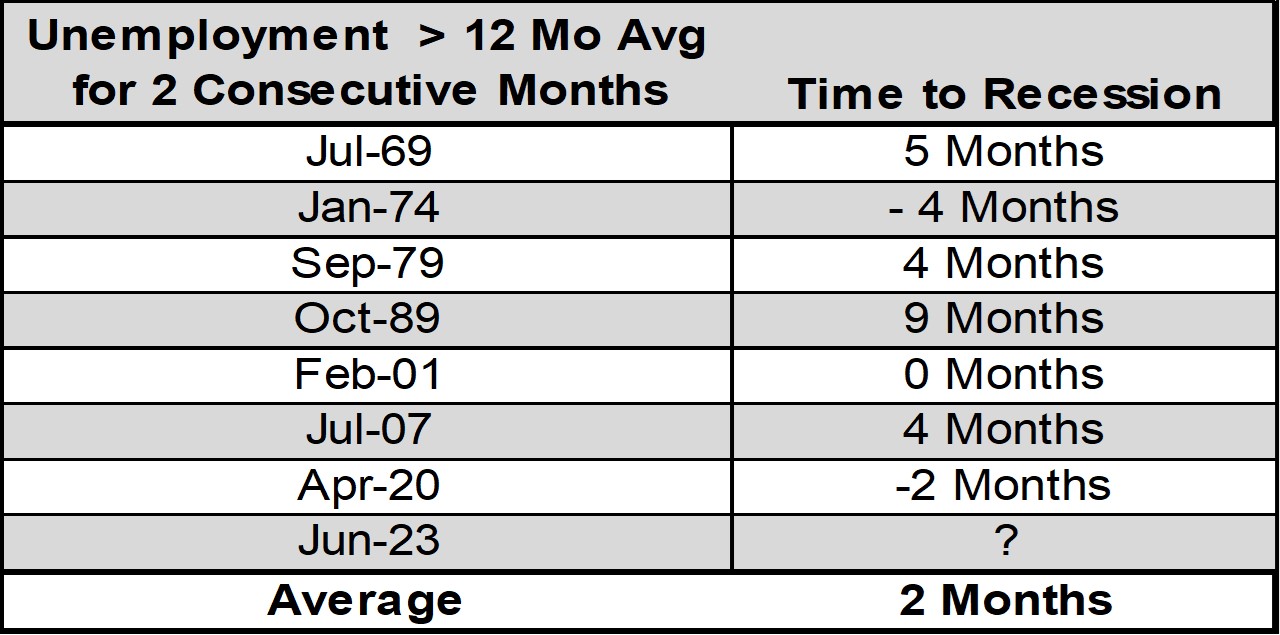

How Long Do We Have Until Recession Hits?

The last time unemployment spiked, we were already too late to prepare for the recession and the bear market. The S&P 500 peaked in February, hit bottom in March and rallied from there. Unemployment typically does not peak until many months after the market bottoms, but the pandemic was an outlier in this case as well, peaking in April 2020. As can be seen below, the average time for the recession to become evident is two months. Based upon this data, it looks like we are close.

We are traveling down an unfamiliar road with few exit ramps. Our fuel tank has just hit empty, but the empty light has yet to flicker. We note a gas station up ahead. Do we stop now or take our chances that we can get fuel a few miles down the road at a cheaper price? It’s not fun when we see cheaper gas a few exits away, but a lot less fun when we run out of gas because we risked staying on the road for too long.

How badly will the Hurricane Hit?

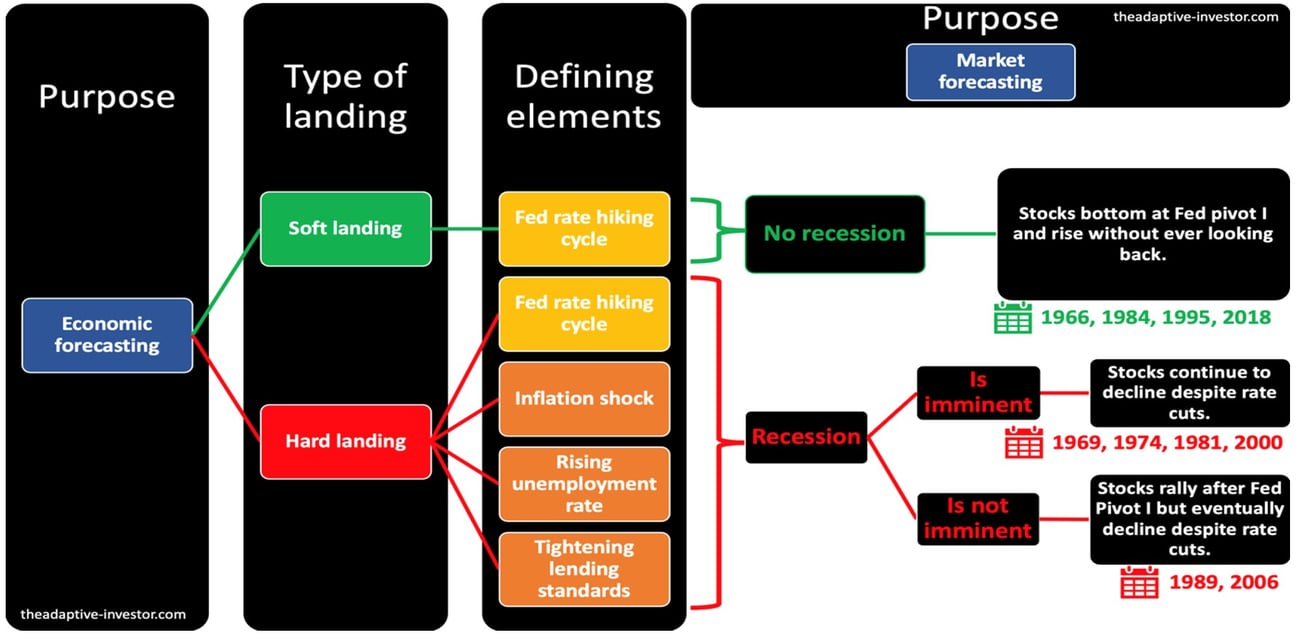

The defining elements of a “Hard Landing” are shown in the diagram below. Most would agree we experienced a nasty inflation shock in 2021 and 2022 mostly in response to an overheating of the economy via fiscal and monetary stimulus combined with supply chain issues. The other two components are not painfully evident yet, but we are seeing the beginnings of what is likely to become obvious for everyone in the upcoming months.

The diagram below seems to point to a “Hard Landing”. Is the recession imminent? If we continue to see unemployment creep up to 3.8% and over 4%, most will start to take notice.

Will Troubled Families and Companies be able to Refinance?

Lending standards have gotten extremely tight once again. We have only seen lending officers grow this picky during the pandemic, the great financial crisis, and the 1970s. Bank of America provides data below showing how hard it is to get a loan currently and shows how lending standards never get this tight without a recession.

How Do We Protect Ourselves & Potentially Profit?

Earlier this year we started to grow more excited about owning bonds when we saw the inflation rate would soon be creeping below 5% and we could get higher yields from bonds and CDs. These “risk free” interest rates on the short end of the curve are now paying better than the S&P earnings yield and much higher than that of the top ten largest companies. In 2021, we were talking about how the stock market looked expensive, but the bond market looked even more expensive. Today, the biggest most popular companies look expensive again, but the bond market is starting to look attractive and will be extremely attractive when rates start to fall again.

Mission Objective: Bringing Bond’s Back in Style

The best time to own treasury bonds is during a market panic. The public starts to throw the baby out with the bathwater and there is a “flight to safety” where treasuries and gold become extremely popular. People feel safe owning U.S. Treasury bonds and gold in times of crisis.

Prior to the end of bear markets and sometimes before the top leading into bear markets, bond prices bottom and we are able to get the highest yields that we may see for the next few years. The best returns will come from owning long dated bonds while rates are coming back down, but we do not want to buy too soon. It is much safter to earn 5% plus on short term bonds, CDs and money markets while we wait for the yield curve to “steepen” and return to normal. When the rates on the longer dated bonds are now the highest, we want to start extending duration for higher yields.

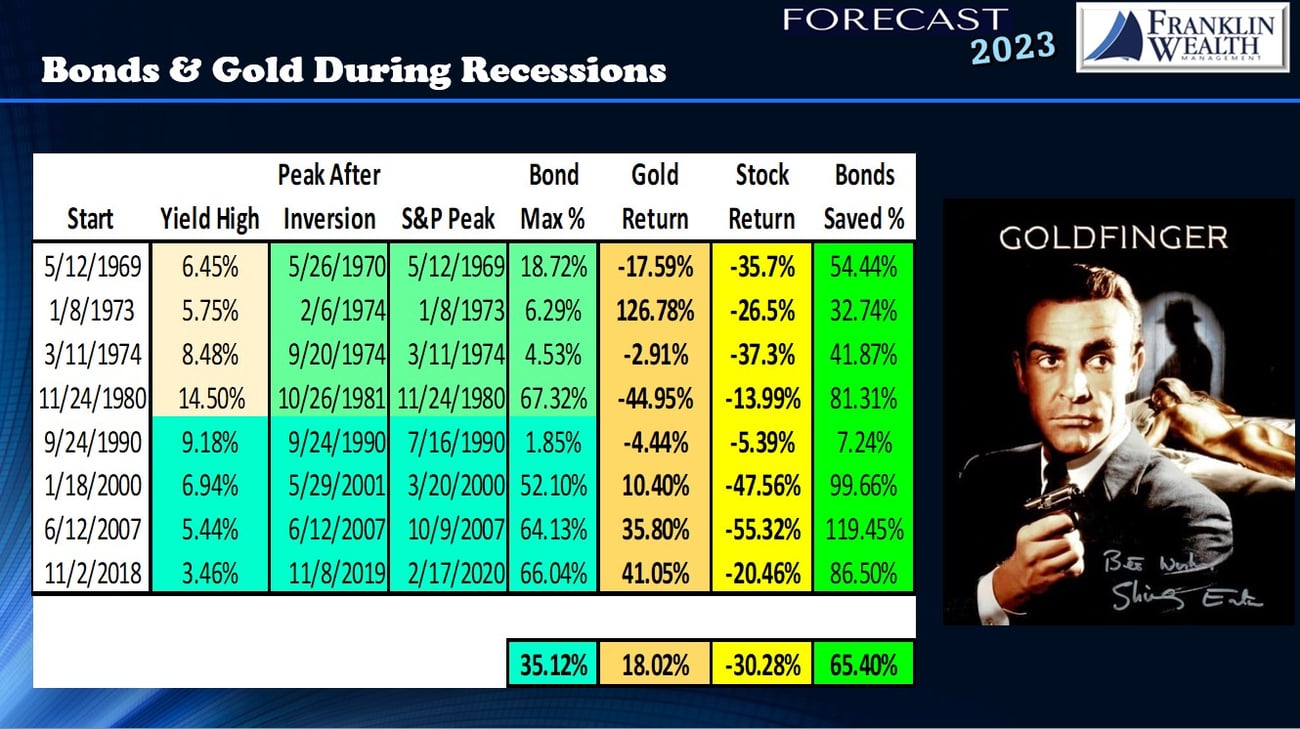

But the best returns are derived from owning long dated treasury bonds during the last part of the selloff when yields sink the lowest. As can be seen below, during recessionary periods, bonds and gold hold up much better than stocks. If we are able to own longer term bonds after the yield curve has returned to normal and hold until the panic sends yields to new lows, long dated treasury bonds can and have provided returns upwards of 50%. In comparison, gold has also provided positive returns during these periods, but stocks have lost 30%+ on average.

We are nearing more milestones on the way to recession and our primary thought is not “if” but “when” it hits and how badly some investors may be hurt. We do not know how hard the hurricane will hit, but hopefully by looking at and learning from the past we can be safely positioned when the worst is upon us.

Joe Franklin has been recognized as one of the Top Advisors in Tennessee

Franklin Wealth Management

4700 Hixson Pike

Hixson, Tn 37343

423-870-2140

www.franklinwealth.com

Check out our Facebook post with the photos from our Hurricane Survival Halftime Report!