The Media is Bullish, But…

Druckenmiller and Other “Gurus” Feel Differently

Billionaire investor Stanley Druckenmiller has amazingly never had a down year in investing throughout his career. He is now putting investors on notice and letting them know that a recession, as well as more difficult market conditions, could be closer than they think.

According to Druckenmiller, “the worst economic outcomes tend to follow asset bubbles.” He expects a “hard landing” with a “20%+ decline in corporate profits” unemployment rising to over 5%, and continued bankruptcies over the next few months. Druckenmiller recently pointed out that the median regional bank has “43% of its loans in commercial real estate” with the majority being offices, noting commercial real estate could be in trouble as asset prices are expected to fall.

His initial assumption is that a recession will start between the fourth quarter of 2023 and the first quarter of 2024, but “wouldn’t be surprised” if it started sooner.

Warren Buffett once related the bit of market appreciation just prior to tops as being akin to staying too long at a party, “but that gets back to the question of Cinderella at the ball. You’re there having a wonderful time; the punch bowl is flowing. The dance partners are getting prettier all the time. But you know at midnight it’s going to turn to pumpkins and mice.”

“You look around the room and you think, ‘One more dance. One more good-looking guy. One more glass of champagne.’

And you think you’re going to get out of there at midnight. Of course, everybody else thinks they’re going to get out of there at midnight too.

And in the end, it does turn to pumpkins and mice.

The problem for this particular dance, for Cinderella, is there are no clocks on the wall.”

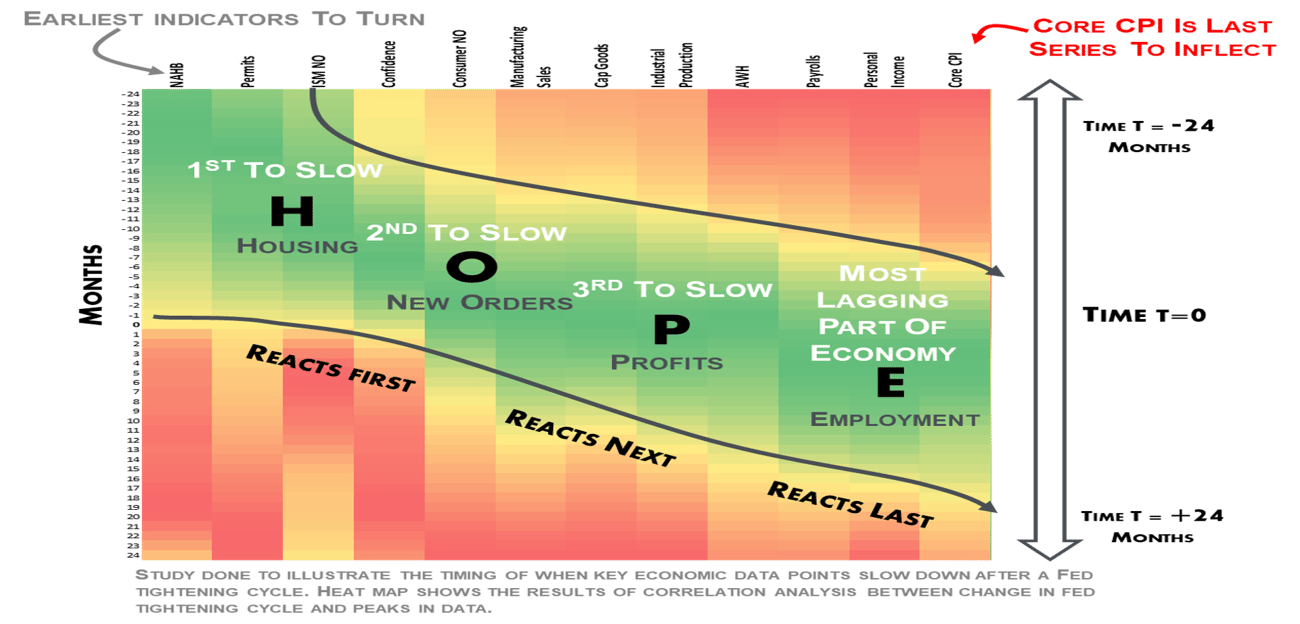

Looking at the HOPE Framework

Piper Sandler, an Institutional Research firm, popularized the HOPE framework as it relates to economic cycles. They and others have noted that Housing tends to weaken first as we go through an economic slowdown. Druckenmiller also likes to look at specific industries that show early signs of recession, such as trucking, which he says is “extremely weak” right now. New Orders tend to slow after housing, followed by Corporate Profits and finally Employment. The Federal Reserve is waiting for this last employment domino to fall before they stop hiking interest rates and noted on Wednesday that they feel employment is still too strong. But where are we starting to see cracks underneath the surface?

How Far Can We Drive on An Empty Tank?

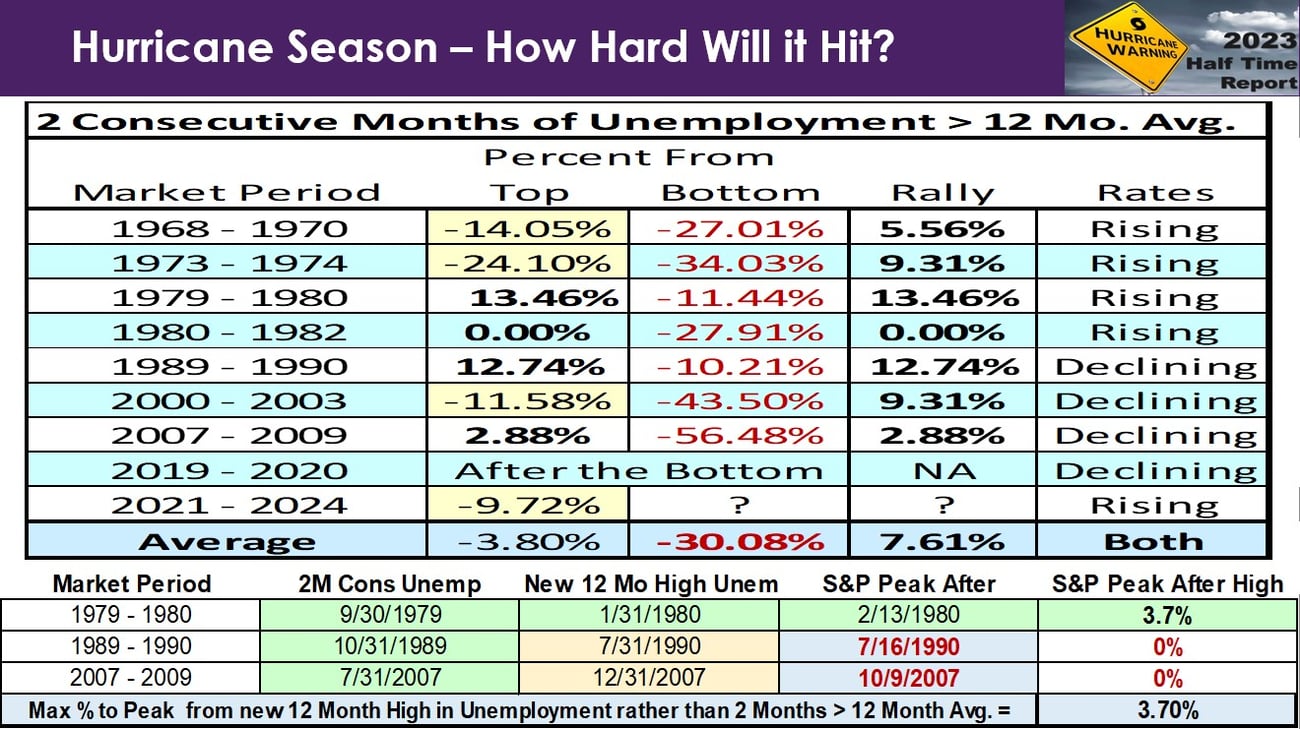

The last time unemployment spiked, we were already too late to prepare for the recession and the bear market. The S&P 500 peaked in February, hit bottom in March and rallied from there. Unemployment typically does not peak until many months after the market bottoms, but the pandemic was an outlier in this case as well, peaking in April 2020. As can be seen below, the average time for the recession to become evident is two months. Based upon this data, it looks like we are close.

We are traveling down an unfamiliar road with few exit ramps. Our fuel tank has just hit empty, but the empty light has yet to flicker. We see a gas station up ahead. Do we stop now or take our chances that we can get fuel a few miles down the road at a cheaper price? It’s not fun when we see cheaper gas a few exits away, but a lot less fun when we run out of gas because we risked staying on the road for too long.

Do We Want to Wait for Further Confirmation?

Employment is typically one of the last dominoes to fall prior to past recessions. The U.S. Dollar has already started to weaken since October of 2022 and on July 7th, the Bureau of Labor Statistics released data showing the unemployment rate is currently at 3.6%. What is interesting is that the unemployment rate is now on an upward trajectory with the last two months clocking in higher than the 12-month average. When this has happened in the past, it was typically not long before unemployment spiked and we were in the middle of a recession. In the past, the markets on average have rallied close to 8% from the time the data comes out only to fall significantly afterwards. From the data below, you can see how the markets have fared after unemployment begins its upward trajectory.

What if we want to wait for further confirmation of higher unemployment? If we wait for unemployment to hit a new 12-month high, many times the equity markets have already hit their highs and we see markets starting to crack. In roughly half of the recessionary periods of the last fifty plus years, the markets topped long before employment started showing signs of slowing. In half of these instances, we were able to get advance warning by looking at unemployment data to see when the last two consecutive months crept above the 12-month average unemployment rate. If we wait to see new 12-month unemployment highs, there has only been one instance in the past fifty plus years where we would be able to get out or reduce risk exposure prior to the top.

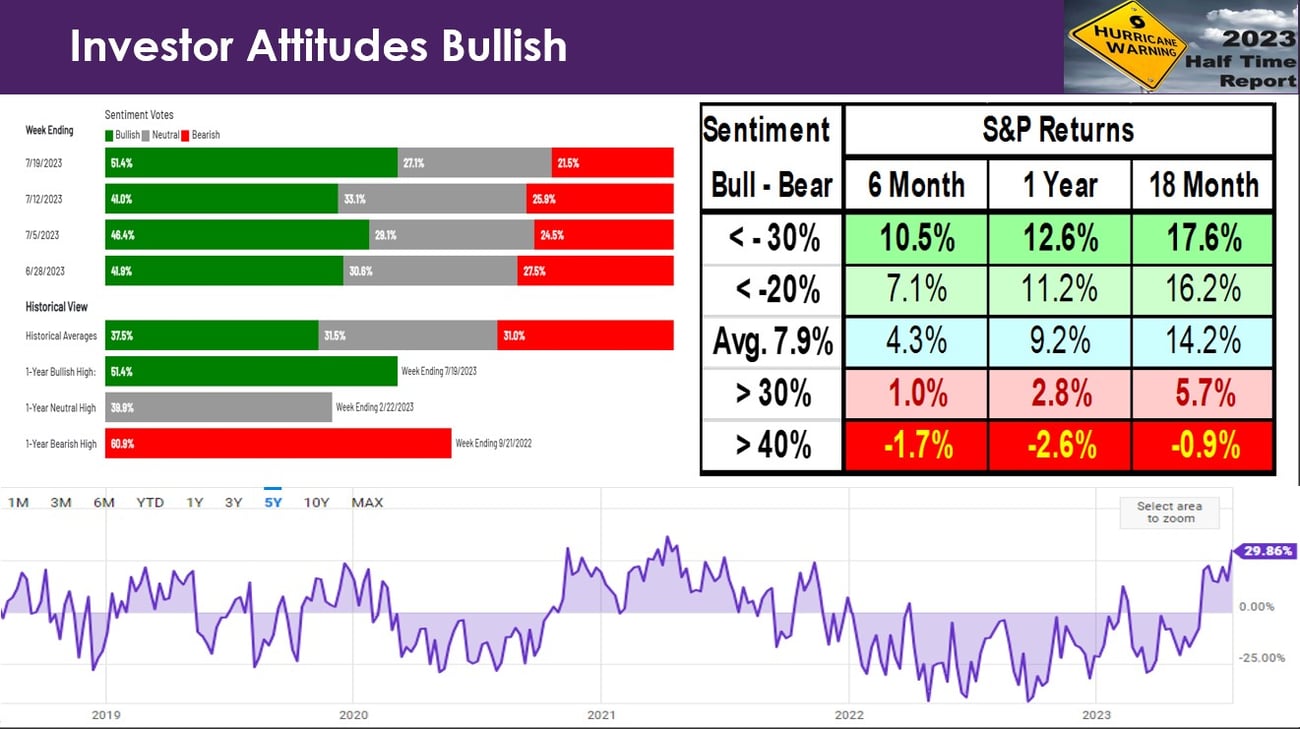

Be Fearful When Others Are Greedy

When publications like Barons start to put pictures of Bulls on the cover, we know we are typically close to a top. When everyone wants to buy, it may be that there are few investors left to put funds to work. The American Association of Individual Investors releases investor sentiment data every week. Last week, Bullish Sentiment outstripped Bearish Sentiment by close to 30%. In the past (this data goes back to the 1980s) when the spread between Bullishness and Bearishness reaches this level, the following six and twelve months provide 1% and 2.8% returns on average for the S&P 500. Considering we can get over 5.5% currently on treasuries and CDs, it looks like equities may not be the most promising investment for the months ahead.

Can the Fed. Put Humpty Dumpty Back Together Again?

Druckenmiller says he “doesn’t know what the Fed wil do” as there is a chance after the asset bubble bursts “Humpty Dumpty” won’t be able to be put “back together again”. This may lead the Fed to inject more stimulus, which could result in a stagflation scenario, categorized by slowing and high inflation. We may end up with something akin to a late 1970s scenario with inflation returning to previous highs.

Druckenmiller doesn’t forecast this will be worse than 2008, but says it is naive to not be open-minded about something “really bad happening”.

As always, we are available to answer any questions you have about the economic cycle, saving taxes over time etc…

Joe Franklin has been recognized as one of the Top Advisors in Tennessee

Franklin Wealth Management

4700 Hixson Pike

Hixson, Tn 37343

423-870-2140

www.franklinwealth.com