Fitch Ratings Cut Sparks Bond Market Selloff

How Does the Recent Rating Impact the Dollar and the Economy?

Fitch Ratings took away America’s triple-A credit this week. The No. 3 U.S. credit rater joined larger rival Standard & Poor’s——after more than a decade—in cutting Treasury bonds from AAA to AA+ on Wednesday, citing well-known economic and political issues that weigh on the country’s finances, particularly a debt measure that is more than twice the amount of similarly rated countries.

This is the first downgrade by a major ratings firm in over a decade and reflects uncertainty in the $25 trillion global market for Treasuries. However, billionaire investor Warren Buffett is not worried about the impact and remains optimistic about U.S. Treasuries. He quipped, “There are some things people shouldn’t worry about. This is one.”

When we consider that the U.S. debt to GDP ratio is twice that of most other nations with similar credit ratings, the U.S. has something those nations do not: “the world’s preeminent reserve currency, which gives the government extraordinary financing flexibility,” Fitch wrote in explaining the downgrade, which is based on “expected fiscal deterioration over the next three years.”

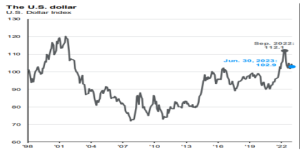

Indeed, the dollar’s popularity with overseas investors and governments—it accounts for 60% of official reserves around the world, according to S&P—gives the U.S. a “license to be irresponsible,” according to some. However, many may not realize that the dollar has been weakening versus other currencies since October of last year.

Many fail to remember that the U.S. defaulted once before in spring of 1979. The default was for only $120 million of the $800 billion the U.S. owed at the time. The U.S. owed other countries less than 3% what it does now and even this small default ended up costing the country 0.6% in interest costs. They called it a clerical mistake, but even this small amount cost the country almost $6 billion a year in extra interest outlays. A similar mistake today would cost us over $200 billion a year.

Borrowing is approaching $33 trillion, more than twice the level when S&P downgraded the country to AA+ in August 2011.

The timing of Fitch’s downgrade goes back to the latest bout of debt-ceiling drama. Richard Francis, co-head of sovereign ratings for the Americas and the author of the negative report, shared that the decision had been made after the latest round of bickering in Washington brought the U.S. to the cusp of default. Congress agreed to suspend the debt limit in June, and Fitch decided to “take a little more time rather than say something right after the resolution,” Francis says. The lifting of the $31.4 trillion cap ends in January 2025, right after the next presidential election, which he points out “is less than two years from now,” adding that the recurring debt-limit crises have been coming roughly every other year since 2011.

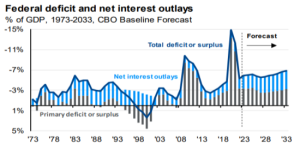

Increasing extremism in U.S. politics is a key issue for Fitch. “The left is moving left, the right more right and the center is falling apart,” says Francis. A road back to triple-A could involve ending the cap and just stabilizing federal borrowing at the current level, he adds. But that would require some combination of spending discipline and revenue increases, which an increasingly divided Washington has shown no ability to execute. Currently the interest on our debt is slated to increase to be more than all other government spending combined by the end of the decade.

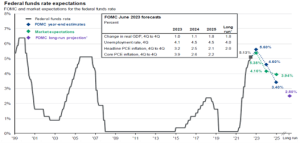

Long-term yields have moved higher over the last few days. We expect short term yields to start decreasing by the end of the year with longer term yields higher than one to two year treasuries by 2024. This is in line with market expectations as well as the expectations of the Federal Reserve. The chart below shows that the Fed expects unemployment to be above 4% by the end of 2023. When this happens, it is likely they will have stopped hiking rates and may be actively cutting rates going into 2024.

Remembering April Fools Day 2021 Economy

A couple of years ago we wrote a “tongue in cheek” article about the S&P ratings agency downgrading our debt again after congress passed a major stimulus spending plan in early 2021. Although we do not see consequences this dire in the coming months or even this decade, we continue to receive warnings from outside agencies that we may want to consider trying to turn this ship around and start to consider more fiscal discipline. Follow this link to view the April Fools Day article.

Joe Franklin has been recognized as one of the Top Advisors in Tennessee

Franklin Wealth Management

4700 Hixson Pike

Hixson, Tn 37343

423-870-2140

www.franklinwealth.com