MANY KIDS WANT CRYPTOCURRENCIES IN THEIR STOCKINGS THIS YEAR

With three teenagers in our household, it has become increasingly difficult to find gifts they will appreciate. Giving cash is acceptable for them but we want to find something that can be more of an experience or something they may not have thought of that will light up their day. Jennifer does not tend to have too much trouble finding something for Sydney and this year Jack has given us some ideas as to what he may want. We thought that with Walker doing so much with his guitar classes that he may want something along this vein, but he seems to be more interested in video games at this point.

A couple of years ago, we bought the kids some Ethereum on Coinbase for Christmas and set up wallets for them. This year we plan on giving them a little more but also giving them some stocks to round out their portfolios. Below are some of the stocks we are having them choose from to include in their portfolios:

AIY (Activision Blizzard), BRK (Berkshire Hathaway), COIN (Coinbase), MELI (MercardoLibre), DoorDash (DASH), Amazon (AMZN), Alphabet (GOOGL), KraneShares China Internet (KWEB), Occidental Petroleum (OXY), Keurig Dr. Pepper (KDP)

It will be interesting to see who does the best with their holdings and who gets the most into stock picking.

The Kobeissi Letter wrote a brief synopsis of the market a couple of weeks ago which somewhat spells out how market participants seem to be trying to make up their mind whether inflation is still here to stay, we are going through a soft landing and growth is coming back soon, or we are heading for a hard landing. Below is what they had to say:

- Stocks are up like we’re in a bull market (still below 2021 Highs)

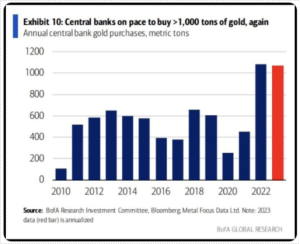

- Gold is up like we’re heading into a recession.

- Oil prices are up like the recession got cancelled.

- Bonds are up like inflation is back below 2%

- Home prices are up like inflation is still at 10%

Everything is up for the wrong reasons?

Buy the Magnificent Seven or Blockchain Investments?

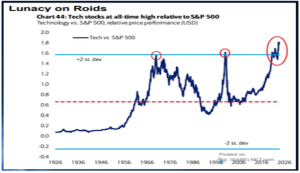

Charlie Munger likely had little good to say about this year’s best performers. We will miss his unfiltered wit and wisdom when sharing his opinions about extremes in the markets. While we would agree with him concerning the Magnificent Seven’s frothy valuations, we feel he did not fully grasp the adoption curve of blockchain technologies and the impact it may have in the years to come.

Blockchain investments have done the best, followed by companies that are implementing AI technologies, including most of the Magnificent Seven companies, year to date. We have benefited from owning the former over the past year while assiduously reducing our exposure to the latter.

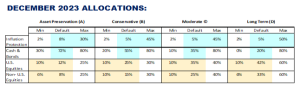

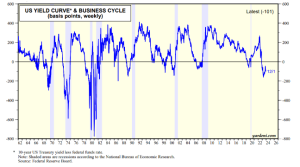

Considering the Federal Reserve has been continuing to raise rates through most of 2023 and the yield curve has stayed stubbornly inverted with short term rates paying better than the earnings yield of the S&P 500, we have been cautiously looking for signs that winter has arrived. We have shifted from “Risk On” to “Risk Off” posture twice this year, buying financial and some technology & energy stocks when the markets tumbled in the second quarter, shifting more heavily to bonds at the end of July and jumping more heavily back into financials, blockchain investments, energy and some healthcare in the fourth quarter to date. We anticipate we will be heading back into a “Risk Off” posture at some point in the 1st quarter.

3rd Quarter GDP was stronger than expected, although the economy is increasing running on consumer debt and government spending. Unemployment hasn’t started to spike yet, although it bottomed in April and investor confidence is currently toward the high side.

After increasing our short term bond exposure in late July, we are now back to a slightly underweight position with bonds currently. We are still waiting for bond yields on longer term bonds to normalize and go higher than the short- term bonds and CDs. It looks like we will have to wait til 2024 for this to transpire, however.

MAGNIFICENT SEVEN OVERVALUED?

If we take out the return of the biggest most popular companies, the S&P 500 return for 2023 would have been negative as of the beginning of November. Very rarely have the biggest most popular companies had so much sway over the markets. We anticipate this will change in 2024. The most recent periods when the biggest most popular companies held so much sway over the markets were in the late 1960s when the “Nifty Fifty” reined and the late 1990s when the “Dot Com” boom and “Y2K” buying was in full force.

We put out the video above on past market manias and how this relates to “Black Friday” a couple of weeks ago. Unfortunately, those who fail to study history are destined to repeat it.

HARD OR SOFT LANDING AHEAD? THE DOMINOES KEEP FALLING

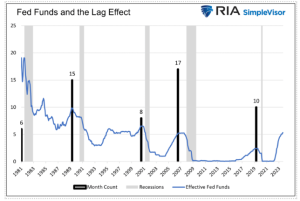

Most have now shifted from predicting when and how much the Federal Reserve will hike rates to when and how much they will cut. This lull in Federal Reserve action typically gives the markets a break as many fail to recognize that they usually start cutting rates only when recession has already arrived. The signposts of an upcoming recession include:

1) An Inverted Yield Curve with Fed. Rate Hikes 2) Rising Unemployment 3) Tightening Lending Standards

4)The Fed Stops Hiking and Starts Cutting Rates 5) Long Term Treasury Rates Peak

We’ve been experiencing an inverted yield curve for well over a year now. Some may expect it to continue for much longer, but these periods are not normal. It is usually only after the long-term bonds are once again paying more than the short-term bonds and CDs that we see the recession rearing its ugly head.

Looking at the past recessions from the last forty plus years, once the Federal Reserve stops hiking rates we have a few months to wait until the recession is upon us and they start cutting again. Many are expecting the cuts to occur as early as March with most central banks around the world already cutting as they enter recessions. The CME FedWatch Tool, gives us a 38% chance that the Fed will cut 25 basis points by March.

Unemployment bottomed at 3.4% in April and has been creeping up since. In October it reached 3.9% and may meet or exceed the Fed target of 4.1% by year end. November showed better than expected numbers and the market rallied afterward. But when job openings start to fall, usually the markets follow. If you take the Magnificent Seven out of this picture, the SPX fails to rally as much but we have yet to see the markets follow job openings down this time around.

Lending Standards are tighter than they have been since the 2008 great financial crisis. Lending growth is currently negative. This has only been the case one other time since the Great Depression.

Usually when heading into recessions, the public flocks to safety and buys U.S. Treasuries. Will it happen again this time around? We suspect it will as there are few other bonds around the world with as much liquidity that are considered “safe” by investors. Increasingly, central banks are buying gold however. There may be a time when other countries largely abandon U.S. bonds for bonds of other countries and gold in times of upheaval and economic downturns, but we still believe long-term treasuries are the best place to be once the yield curve normalizes the fed starts cutting rates and the recession is in full swing.

Forbes Recognized Joe Franklin as one of the TOP Advisors in Tennessee

Franklin Wealth Management

4700 Hixson Pike

Hixson, Tn 37343

423-870-2140