Have you ever known something was right for you and been told you couldn’t have it? It can be pretty frustrating. Many high-income earners, who would like to contribute directly to Roth accounts, cannot do so because of IRS income limits. However, that doesn’t mean it’s impossible for high-earners to reap the benefits associated with Roth accounts, such as tax-free growth, tax-free distributions (as long as certain requirements are met), and no required minimum distributions. Many are now utilizing “back-door” Roth contribution strategy that has been available since 2010. If this applies to you, then you may be able to participate in Roth accounts by:

1. Converting an existing Traditional IRA to a Roth IRA. Anyone can move the assets accumulated in a Traditional IRA account to a Roth IRA account, regardless of income. The catch is you’ll owe current income tax on the amount converted. This may be a sound choice if:

- You want tax-free income during retirement. As long as you are age 59½ or older and have had the Roth at least five years, withdrawals typically are untaxed.

- You expect to be in the same or a higher tax bracket in the future.If you expect to be in a lower tax bracket in the future, a conversion may not be the best choice.

- You can pay taxes owed from sources other than the IRA account.If you are not yet age 59½, any IRA money used to pay taxes is considered an early withdrawal and subject to a 10 percent penalty tax.

- You plan to leave the account for your heirs. Roth IRAs can be valuable estate planning tools. They are not subject to required minimum distributions, so you don’t have to take money out if the goal is to let any earnings grow tax-free and accumulate for your heirs.

“By paying the conversion tax bill, you are effectively prepaying income tax for your heirs without owing any gift tax or using up any of your valuable unified federal gift and estate tax exemption ($5.43 million for 2015). Plus, the income tax prepayment reduces your taxable estate, which is also a good thing,” reported MarketWatch last April.

2. Complete a “back door” Roth conversion. If you earn too much to contribute directly to a Roth IRA (adjusted gross income of $131,000 or more for a single filer; $193,000 for joint filers in 2015) then you can contribute to a non-deductible Traditional IRA and convert it to a Roth IRA. This is called a backdoor Roth conversion. It may have some appeal for high-income individuals even though IRA contribution limits, which are $5,500 in 2015 ($6,500 if you are age 50 or older), make it difficult to build a substantial position.

Before pursuing a backdoor Roth conversion, it’s essential to thoroughly understand the rules and limitations. For example, the pro-rata rule requires individuals who are completing backdoor Roth conversions to calculate taxes owed across all untaxed IRA assets. So, if you have other IRAs that have not been taxed then a pro-rata portion of any assets converted to a Roth IRA may be taxable.

For instance, if Mary completes a $5,000 backdoor Roth conversion and has no other untaxed IRA assets, the only taxes due would be those on any appreciation in the value of investments held in the non-deductible Traditional IRA. However, if Mary has $95,000 in Traditional IRA assets that have never been taxed, a pro-rata portion of her Roth conversion may be subject to taxation. Since 95 percent of her IRA assets are untaxed, 95 percent of the conversion amount may be taxable.

There are some workarounds that can help resolve this issue. If your employer-sponsored 401(k) plan allows it, you may be able to roll untaxed IRAs into the plan. If the plan passes muster, the roll-in must occur before initiating a Roth conversion. Alternatively, if you are self-employed, you may be able to roll the assets into an individual 401(k) plan. Either way, the assets would no longer be considered under the pro-rata rule.

If you complete a Roth conversion of any kind and regret the decision, you can recharacterize the conversion by converting the Roth IRA assets back into a Traditional IRA. This must be done within specific time frames.

3. Make Roth contributions to a 401(k) plan. Not all employer-sponsored retirement plans offer Roth 401(k) plan contributions. If yours does, take advantage of it. There are no income limits on Roth 401(k) contributions and contribution limits are more generous than those for Traditional IRAs. During 2015, plan participants may contribute up to $18,000 to a 401(k) plan account, plus up to $6,000 more, if they are age 50 or older.

No matter how much money you earn, it is possible to enjoy the benefits of a Roth account. Just make sure you talk with a financial professional and understand the rules, limitations, and potential impact of any conversion before you take action.

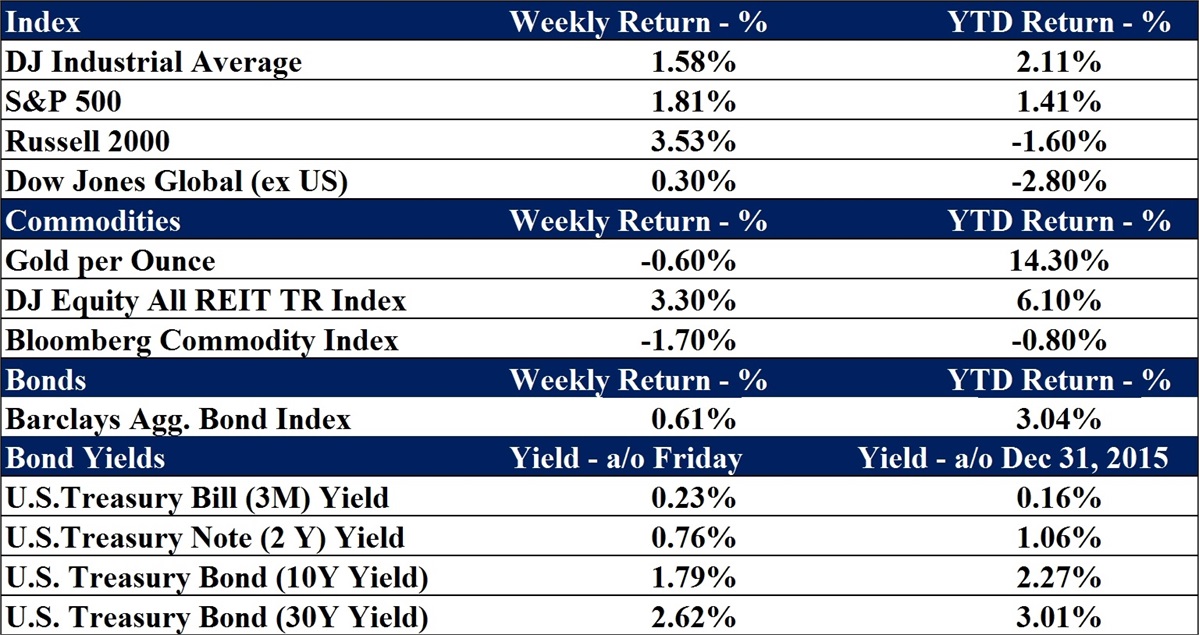

Data as of 4/1/2016

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20-year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request