On our recent trip to New York I re-read the book Getting Naked. It was totally appropriate considering some of what we saw walking through Time’s Square. I hadn’t been packed in any crowds quite this large, varied and rowdy since the last time we visited New Orleans. Many were there to make money from the visitors via various means. Each of these individuals had a gimmick to earn fans, tips and attention getting dressed or un-dressed for particular effect.

The lessons of the book Getting Naked provide a completely different recipe for servicing clientele and building a strong business than the type we saw in Times Square. Rather than relying on gimmicks, promotions or slick presentations to gain business, the lessons instead are based upon tenants that many in this age may consider somewhat backwards.

The book is primarily about making ourselves vulnerable to better serve our clients. Many of us struggle with this type of vulnerability because we are human beings who don’t like to be weak, which means we are subject to the completely natural but irrational fears that make us uncomfortable being naked. But the ability to be vulnerable in order to benefit our clients allows us to provide better service and be more effective in the long run.

Going back through the book I remembered discussing how we approached our business with Tyler a few years back. Having come from a brief insurance background he was a little surprised that we never seemed to sell anything. I explained to him that when you believe in what you are doing and you have conviction that what you are advising is the right thing for the client, you rarely have to sell your ideas. People take your advice. I have consistently worked with several other advisors over the years to help them focus on what they have the most interest and conviction in. Why would you ever want to advise someone to do anything that you wouldn’t want to do yourself or anything that you wouldn’t also advise your spouse, mother or sibling to do?

Of course if the temptation exists to recommend something based upon a higher payoff, a quota or some other incentive there is always the possibility that some may succumb and conflicts of interest may arise. In our household, I have found that the easiest way to avoid temptation is to take it out of the house. If you want to keep from eating junk food, don’t keep any in the pantry. Likewise, if you want to avoid conflicts of interest it may be best to work with a company that does not have any proprietary products to offer clients. We rid ourselves of most conflicts of interest when we left our previous firm and joined an independent firm without any proprietary products or other types of junk food (Wall Street’s Pigs and Wolves).

Another one of the better ways to put advisors on the same side of the table as clients is to work on a fee basis and own the same securities and products so we are not only more familiar with the holdings but we can all take advantage of opportunities or protect ourselves at the same time. Some may say we as fee based advisors make money whether clients are doing well or not. This is true to a limited degree, but in this case our portfolios suffer when clients suffer and outperform when clients outperform. The airline pilot gets paid whether he lands safely or crashes, but he is definitely motivated to land safely. By owning the same portfolios as clients we are acting much like the airline pilot.

THE THREE FEARS

The book speaks to key strategies to do a better job for clients by putting our ego aside and letting go of our fears. The three major fears are included below.

#1 Fear – Fear of losing the business: What clients want more than anything is to know that we’re more interested in helping them than we are in maintaining our revenue source. And when we do something, or fail to do something, in order to protect our business, they may lose respect for us and understandably question whether they should trust us.

- Always consult and give advice instead of selling. However if someone is in danger of jumping off a cliff and hurting themselves, you only do them harm by not being more forceful.

- Be sincere and tell the kind truth: If you do not have to occasionally tell a client something he or she might not want to hear, you are not being a true advisor.

- Give away the business: We make a point to give a lot of value to clients before they become paying clients although we have found over time that we are more engaged when we are compensated and clients are more committed when they have skin in the game.

- Enter the Danger: Dealing with the elephant in the room is never easy, but it is necessary and appreciated by most.

#2 Fear – Fear of being embarrassed: This is one fear that I probably wrestle with more than some. The author advises us to admit what we don’t know and be quick to point out and even celebrate our errors because protecting our intellectual ego should not be important to us. Take a look at Larry the Cable Guy in the picture taken with the Naked Cowboy in Times Square. Many of us would be embarrassed to prance around in our underwear if we looked like him, but we admire him for it and celebrate his courage. And it is extremely funny.

- Don’t be afraid to ask “dumb” questions: Ask the questions that others are afraid to ask. Others may be thankful that you do.

- Don’t hold back on seemingly dumb suggestions: Many times these dumb suggestions hide genius within them and clients tend to remember the great ideas more than the dumb suggestions that are thrown aside

- Celebrate your mistakes: You do not have to enjoy being wrong, but if you are working hard for a client you eventually will be. Only those who sit on their laurels and do nothing are never wrong. Take responsibility for mistakes and own up to them.

#3 Fear – Fear of feeling inferior: Once again, I would think that Larry the Cable Guy may have overcome this fear. We have to remember that we have to place ourselves in a position of service to do a good job for our clients.

- Take a bullet for the client. This is about finding those moments when we can humble ourselves and sacrificially take some of the burden off of a client in a difficult situation, and then confront them with the kind truth. This happens less in the wealth management business than others in that everything has to be documented so stringently, but it could be a situation where we take the blame and assume the mantle of the bad guy to help our clients save face.

- Put the clients’ interests ahead of our own: As a registered investment advisor we are required to do this. We are held to a higher standard by the SEC in that brokers are only required to advise what is suitable.

- Honor the clients work and do the dirty work: We need to be willing to take on whatever the client needs within the context of our services. Many times this may be done by a service person within the practice but we are always striving to go above and beyond and take an interest in those things that are important to our clients.

In essence the book Getting Naked is all about servicing the clients the way they would like to be serviced if they had perfect knowledge concerning what they want and need. Knowing the right thing to do comes from experience and being able to listen to clients’ needs and desires although perfect knowledge is almost never achieved. To the extent we can acquire the knowledge, understanding, be able to execute and have the discipline to do the right thing we will be successful for clients at least by my definition.

Next week we will be hosting our Half Time event at the Chattanoogan with Jeff Kim manager Good Harbor Tactical Equity Income.

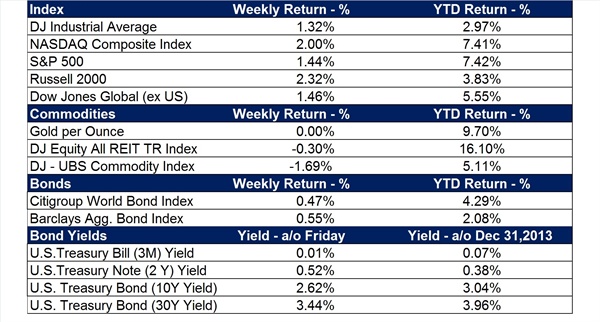

As you may already be aware, last year REITs, MLPs, other Energy companies and commodities all performed poorly. Our ownership of these types of holdings kept our portfolios from performing as well as most US Stocks. Last year was the year to own the most speculative US stocks and any diversification temporarily did not work as well as just owning a concentrated US stock index. This year is a different story. Those that are not diversified into any of these types of holdings are not performing as well as those who are. We will be updating everyone on what transpired during the first half of the year on the 17th and what we are looking for going forward.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.