We truly enjoyed our time in St. Kitts and Nevis. The islands are just now beginning to see tourists again as they have loosened their travel restrictions requiring quarantine of 4-5 days currently compared to a full two weeks in the recent past. Jennifer loves it so much; she wants to buy a place on one of the islands. We will be taking the kids back eventually, once they no longer have a quarantine requirement.

We can all dream about going back to a simpler time and being on the islands does that for us, but twenty years after the terrorist bombing in New York, it seems air travel has not gotten any simpler. On this trip we endured four Covid tests over two weeks to be able to enter the country, move about freely and head back to the United States. We also had our temperature checked and were sanitized upon entering almost every building. Hopefully our grandchildren will be able to live in a world where masks and Covid testing is not required to travel, security is not as onerous, and people can feel safe.

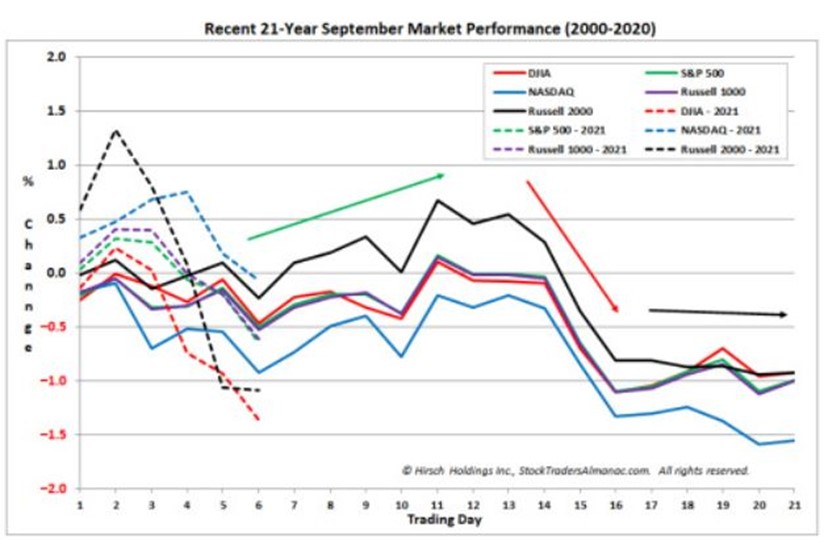

When we think of September, many of us remember the terrorist attacks on the 11th in 2001 and a few remember the Lehman Brothers collapse on September 15th, 2008. This month has long been one of the worst months to be invested, giving investors negative returns on average since the 1950s. Typically, the markets take a turn for the worse in the latter half of the month hitting lows during the month of October. The chart below shows the U.S. markets’ track record during this month over the last twenty years.

I don’t think we will ever experience a time in my lifetime where terrorists, sickness and financial downturns are eradicated. The most extreme way to avoid these things is to never go anywhere other than remote places, never associate with others and never invest in anything outside of cash equivalents and insured deposits. Most of us want to experience more out of life, so we are willing to take some risks.

The terrorist attacks of 2001, the collapse of Lehman Brothers in 2008 and the rampant spread of the coronavirus in 2020 were all catalysts that transitioned weak economies and weak markets into periods of panic selling and extreme anxiety. When we think about these events, we note causes which seem so easy to recognize after the fact. We watch for something similar to be wary of in the future. For this reason, market collapses and panic selling always seem to stem from something new and unexpected.

What factors are almost always present prior to the largest selloffs?

Federal Reserve tightening and interest rate hikes – We are currently encountering stimulus action from the “Fed” rather than tightening. Eventually the Federal Reserve will need to tighten, however.

Leading economic indicators look weak including yield curve inversions. – Currently we are more concerned about the economy getting too hot with supply chain issues and dollar debasement causing inflationary pressures. The yield curve has started to flatten some, however.

A calm before the storm – Volatility levels are currently floating around the 20.1 long term average reading. These levels give us less predictability than an extremely low or high reading. We would be more concerned if we were floating around extreme lows similar to late 2017.

Market breadth narrows. New highs seen from fewer and fewer stocks – We encountered unfavorable market breadth conditions in July with a lower percentage of stocks hitting new highs as the market averages continued to march forward. This led us to reposition portfolios as noted in our August publication.

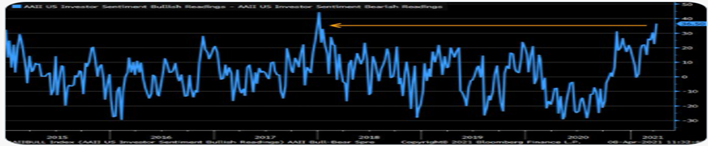

Extreme investor confidence – Investor confidence peaked earlier this year in April signaling weaker conditions. The highest readings of the last five years were achieved in January 2018 ushering a year of underperformance. The chart below shows investor optimism from 2014 through April 2021.

A period of bond and/or utilities outperformance – Long duration bonds have been outperforming most stocks since mid-March. We have increased our bond exposure over the past couple of months. We wrote more about this in our August publication.

Little to no insider securities purchases – CEO selling exceeds buying 3 to 1 for the companies they manage. CEOs are in a better position to know more about these companies than most.

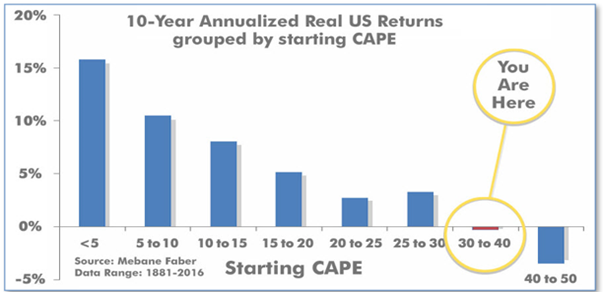

Extreme valuations – By most measures, the U.S. markets are more richly valued than ever before. In the short run, these valuations can be stretched even farther and this is probable as long as the government continues to stimulate the economy. In the long run, U.S. markets historically have not fared well with valuations this rich. Last week the Cyclically Adjusted Price Earnings ratio (CAPE) was sitting at 39.8. This is the highest reading we have seen in over 20 years. With readings this high the average return over the next 10 years for U.S. markets has been negative, historically.

What is the most surefire way to get poor investment results?

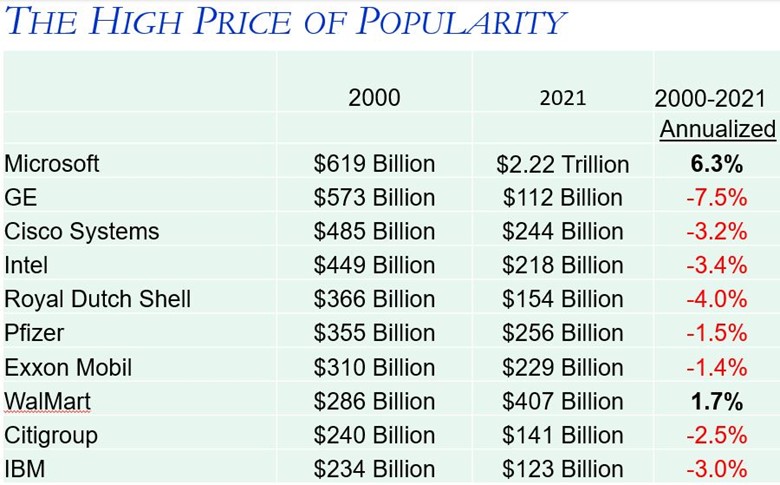

If you want to have the best chance to lose money, start buying when most or all of the factors above are present and invest in the most expensive, biggest most popular companies. As can be seen from the figure below. Those who bought the ten largest most popular companies in late 1999 or early 2000 lost money on average over the next ten years and only had a chance of making money after dividends are added over the last twenty-one-year period.

It is worthy to note that those who reduced exposure to the largest most popular U.S. companies and diversified overseas and/or in smaller companies made money in the 2000s. This is the decade frequently referred to as the “lost decade” for those invested in something like an S&P 500 index fund.

To improve our odds for success we want to diversify overseas and look at temporarily unloved smaller companies that are either managed extremely well, at the cusp of a new technology or trend, have a business where it is hard for others to enter or compete or a combination of all the above. We want to find “Tomorrows Blue Chips Today” rather than investing by looking in the rear-view mirror. It may sound good to tell someone you own one of these popular stocks, but it is not always a good recipe for success unless you found them BEFORE they became expensive, big and popular.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.